Offshore wind energy has emerged as a promising renewable energy source for Türkiye, offering a sustainable and abundant source of electricity to meet the country’s growing energy demands.

This article delves into the current status of offshore wind energy development in Türkiye, evaluating the progress made, identifying areas for further advancement, and drawing insights from sector leaders to inform future strategies.

The analysis reveals that Türkiye has made significant strides in recent years, establishing a supportive regulatory framework, conducting offshore wind resource assessments, and initiating pilot projects. However, the country also faces challenges, including the need for enhanced grid infrastructure, streamlined permitting processes, and refined tender and auction procedures.

To overcome these challenges and unlock the full potential of offshore wind energy, Türkiye can adopt best practices from sector leaders. This includes implementing transparent and competitive tender and auction mechanisms, providing financial incentives, and fostering collaboration among stakeholders.

Additionally, Türkiye can leverage technological advancements to reduce costs and improve efficiency, while ensuring environmental sustainability and addressing potential concerns of local communities.

By adopting these strategies, Türkiye can position itself as a frontrunner in offshore wind energy development, reaping the economic, environmental, and social benefits that this renewable energy source can offer.

The future of offshore wind energy in Türkiye holds immense promise, and by addressing the existing challenges and embracing best practices, the country can harness the power of the wind to fuel its sustainable energy future.

INTRODUCTION

As the world transitions towards a more sustainable energy future, the potential of offshore wind energy has emerged as a beacon of hope. With its vast coastline and abundant wind resources, Türkiye stands poised to harness this transformative technology and reap the benefits of clean, renewable energy. However, the path to realizing Türkiye’s offshore wind potential is not without its challenges.

Offshore wind energy holds immense promise for Türkiye, but its development has been hampered by a complex interplay of regulatory, sectoral and lack of experience obstacles. What should be done is that implementing of other sectoral countries regulatories and systems thay applied for offshore regulations to Türkiye.

In this regard, it can be claimed that the interpretation of other countries’ experiences suggests that a well-designed regulatory framework and transparent tender procedures are essential for attracting investment and accelerating the growth of the offshore wind energy sector.

Navigating the Regulatory Landscape for Offshore Wind Energy in Türkiye

As Türkiye taps into the potential of offshore wind energy, a robust regulatory framework is crucial for its successful integration into the national energy mix. In this chapter, I will explain the current situation and make comparison between other countries.

The Electricity Market Law (Law No. 6446) can serve as the cornerstone of Türkiye’s offshore wind energy regulatory framework, providing the structure and principles for project planning, implementation, and operation. It can recognize offshore wind energy as an eligible renewable energy source, establishes a feed-in tariff mechanism, and outlines the responsibilities of relevant authorities (Kütükçü, G., 2022).

Streamlining permitting procedures, enhancing grid infrastructure, and promoting regulatory clarity are key challenges that need to be addressed to accelerate offshore wind energy growth (Şentürk, A. E. 2020). Overcoming these challenges will require ongoing collaboration between government agencies, industry stakeholders, and academia to unlock Türkiye’s offshore wind energy potential. At this point, I will explain which regulatory frameworks the European Countries use for this sector in order to estimate the potential strategies for Türkiye in this sector.

How do other countries lead this sector?

Countries around the world have implemented various mechanisms to support the development of offshore wind energy, including contract for difference (CfD) agreements, feed-in tariffs (FiTs), and subsidy schemes(Jansen, M. 2022). These mechanisms provide financial support to offshore wind projects, helping to reduce the cost of electricity generation and make offshore wind energy more competitive with traditional fossil fuel-based power sources (ESMAP. 2020).

Contract for Difference (CfD) Agreements

Under a CfD agreement, the government guarantees a fixed price for electricity generated from an offshore wind project. The project developer receives payments from the government if the wholesale electricity market price is lower than the CfD strike price. This helps to protect project developers fromOffshore Wind Report, 2022 .

Countries that have implemented CfD schemes for offshore wind energy include the United Kingdom, France, and the Netherlands.

Feed-in Tariffs (FiTs)

A FiT is a fixed price that the government pays for electricity generated from a renewable energy source, such as offshore wind. The FiT is typically guaranteed for a period of several years, providing project developers with a predictable revenue stream.

France used FiTs for its first two offshore wind auctions, but has since switched to a CfD scheme.

Subsidy Schemes

In addition to CfD agreements and FiTs, some countries also provide direct subsidies to offshore wind projects. These subsidies can be in the form of grants, loans, or tax breaks.

The Netherlands has a subsidy scheme called SDE+, which provides one-sided CfDs with a certain floor market price. Denmark also has a subsidy scheme for offshore wind energy, which provides support for wind energy production for 15 years without indexing it to inflation.

Open-Door and Auction Systems

Countries use different methods to initiate new offshore wind projects. Some countries, such as Denmark, use an open-door system, which allows project developers to conduct specific preparatory work independently. Other countries, such as France, use an auction system, which involves negotiations, announcements, and selection phases (Offshore Wind in Europe Key Ternds and Statistics. 2023).

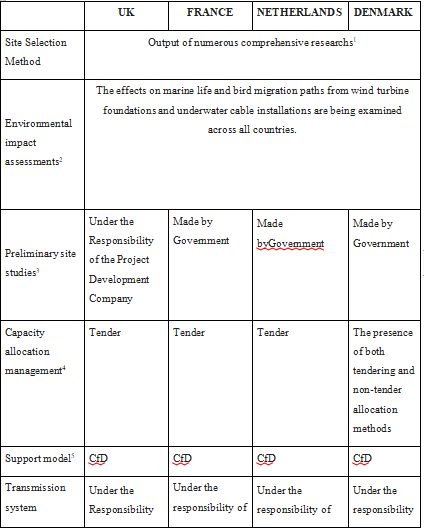

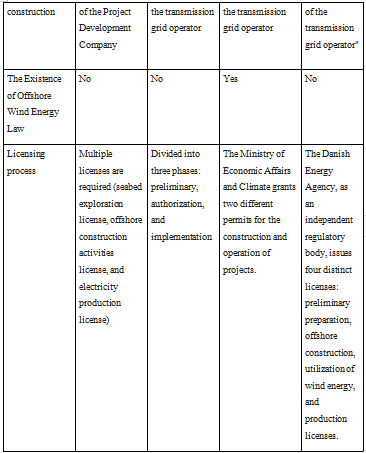

General Comparison

This section aims to create a tabular representation outlining the general framework employed by these countries in the offshore wind energy sector as follows:

What About Türkiye?

The Turkish government has set ambitious targets for offshore wind energy, with the goal of installing 10 GW of capacity by 2030. To achieve this goal, the government has taken a number of steps (TÜREB & SHURA. 2023), including:

- Launching the YEKA offshore wind auction in 2018: The auction was canceled due to lack of bids, but it laid the groundwork for future auctions.

- Signing a memorandum of understanding with Denmark in 2018: The memorandum of understanding aims to develop a roadmap for offshore wind energy in Türkiye.

- Working with the European Bank for Reconstruction and Development (EBRD) to develop a wind atlas: The atlas provides information on wind speeds and resources in Türkiye.

The YEKA Auction:

The YEKA offshore wind auction was a landmark event in the development of offshore wind energy in Türkiye. It was the first time that the Turkish government had held an auction for offshore wind projects, and it was seen as a step towards the country’s goal of installing 10 GW of offshore wind capacity by 2030.

The auction was held in 2018, and it was for a total of 1200 MW of capacity in three zones: Gelibolu, Saros, and Kıyıköy. The winning bidders were to receive a guaranteed price of 8 US cents/kWh for the first 50 TWh of electricity generated (TÜREB & SHURA. 2023).

However, the auction was ultimately canceled due to a lack of bids. The government attributed this to a number of factors, including the high price of the auction, the lack of experience of Turkish developers in offshore wind, and the uncertainty surrounding the regulatory framework for offshore wind energy in Türkiye (Şentürk, A. E. 2020).

Despite the cancellation of the auction, the YEKA process laid the groundwork for future auctions. The government learned from the mistakes of the first auction and made adjustments to the process for future auctions. For example, the price of the auction was lowered, and the government provided more support to Turkish developers.

The cancellation of the first YEKA auction was a setback, but it did not deter the government from its commitment to developing offshore wind energy in Türkiye. The government is continuing to work with industry stakeholders to develop a roadmap for offshore wind energy in Türkiye, and it is expected that future auctions will be held in the coming months (Kütükçü, G., 2022).

The memorandum of understanding with Denmark:

The MoU between Türkiye and Denmark aims to establish a strategic partnership to share expertise and resources in developing offshore wind energy projects. The MoU covers technical, procurement, financing, and regulatory cooperation. It will help Türkiye achieve its offshore wind energy goals and create a supportive environment for the industry’s development.

The Wind Atlas of Offshore Wind Energy:

In 2020, the EBRD and the Turkish government collaborated to develop a comprehensive wind atlas, assessing Türkiye’s offshore wind and wave energy resources. This detailed mapping provides valuable information for project feasibility studies, investment decisions, and strategic planning, empowering stakeholders to make informed decisions and accelerate the development of offshore wind energy in Türkiye.

Interpretation And Recommendation

Generally

Analysis of the current status of onshore wind energy projects in Türkiye is the first step to understanding how widespread these types of projects are in the country. When projects in operation or partially in operation, as well as projects in the pre-licensing stage, are included, Türkiye has allocated a capacity of approximately 16 GW. According to the Türkiye Wind Energy Potential Atlas published in 2006, the total capacity of wind power plants that can be installed in Türkiye was estimated to be approximately 48 GW .

This calculation specified 38 GW for onshore wind energy and 10 GW for offshore wind energy capacity. This suggests that the onshore wind energy potential has not yet been fully utilized (TÜREB & SHURA. 2023).

The Marmara Region’s high energy demand and limited land availability make it a prime location for offshore wind energy projects. Regular and high-speed winds on the sea and sufficient land for facility installation support the development of large-scale offshore wind energy in this region. At this point, as policy-maker, there should be focus on this region while applying incentives.

Determining the locations in Türkiye’s maritime areas is important, especially because it is not possible to move away from the coast due to the deepening of the sea. For this reason, it is a natural necessity that the projects to be built be close to the coast. This also does not increase the cost of the energy transmission lines to be built. It can be suggested that Türkiye use floating systems considering the characteristics of the seas, but this may be a difficult application for Türkiye at this stage (Kütükçü, G., 2022).

The costs of offshore wind energy projects should also be evaluated. It is likely that the initial investment cost of such a project in Türkiye will be higher than the costs indicated in international reports. Therefore, calculating the cost of the project in detail in a potential tender announcement, presenting the cost clearly, and determining the ceiling purchase price to be determined in the tender will be a critical factor.

Ports used in such projects are also important. The use of special ships and the need for special ports play an important role in the development process of the project. It is important to evaluate the suitability of the ports in the sea area where the project is to be developed for the equipment logistics and transportation operations required for the installation of these projects.

When these types of projects are associated with goals such as increasing localization and technology transfer, it is important to consider the localization targets when considering the first stages of Türkiye’s offshore wind energy projects. It is important to consider these conditions when considering the localization requirement, especially since there is no market in this area yet.

In the Perspective of Law

Offshore renewable energy sources (RES) projects have significant potential in terms of Turkey’s energy needs and local production targets. However, it is not easy to achieve the local content targets in this area at the initial stage. The fact that there is no clear market for offshore RES projects in our country shows that the local content requirement should be considered in the light of these circumstances in a possible tender (Kütükçü, G., 2022).

One of the most critical issues regarding the competition ceiling price to be determined in the tender is that the ceiling price to be determined for the production facilities to be established under the YEKA Regulation is mandatory in Turkish Lira, with the change made in the Law on the Use of Renewable Energy Sources for the Production of Electrical Energy No. 5346 (Şentürk, A. E. 2020). The support prices determined by the Presidential Decree were also announced in Turkish Lira. Therefore, it is a mandatory condition within the framework of the current legislation that the ceiling price in the tender announcement for offshore WEP projects is in TL.

It is thought that the support prices made especially for wind energy projects are based on onshore WEP projects, and for this reason, a separate support price should be determined for offshore projects. The support prices determined by the Presidential Decree are updated every three months based on the Producer Price Index (PPI), Consumer Price Index (CPI), and the exchange rates of the US Dollar and Euro.

This update is related to the determination of support prices in TL. Therefore, in a planned offshore WEP competition, it is also very important to determine the basis on which this price will be updated in certain periods, as well as the price at which the competition ceiling price will be determined in TL. It is thought that it would be more effective to determine the update prices only in US Dollars and Euros to ensure the participation of international investors.

An important issue for offshore WEP projects is the dismantling of turbines that have completed their lifespan. These turbines are thought to have a lifespan of 20-25 years, and it is important that they are removed from the sea after their use is completed.

The specifications should include provisions on how these facilities will be dismantled and emphasize that the process is the responsibility of the company. In this context, it is considered that the relevant authorities should take additional guarantees from companies regarding the dismantling of turbines to ensure the process, taking into account environmental concerns and potential effects in the seas.

Another important finding from international studies (as displayed in a table above) is that the regulations related to the sea in offshore WEP projects are monitored by an institution. There is no special regulatory body for the seas in our country yet. For this reason, it is thought that a structure that will examine a broad perspective on the seas may be needed in the process of developing these projects in sea areas.

Similarly, it is seen that the processes related to offshore WEP projects are carried out by a specific institution in some countries, while they are coordinated by more than one organization in some countries. In Turkey, the fact that the processes in the YEKA model are carried out by the Ministry of Energy and Natural Resources shows that the model managed by a single responsible institution is suitable for offshore WEP projects (Jansen, M. and others, 2022).

Especially in Denmark, it is seen that support mechanisms are increasing in projects that are farther from the coast and deeper for the development of offshore WEP projects. However, the fact that Turkey’s sea areas are not deep and the limitation of moving away from the coast shows that support mechanisms should focus on encouraging the use of domestic products.

CONCLUSION

In summary, Türkiye’s offshore wind energy sector has demonstrated remarkable progress in recent years, laying the groundwork for a promising future. The establishment of a legal framework, resource assessments, and initial tender processes have paved the way for further expansion. However, several challenges remain to be addressed for accelerated growth, including streamlining permitting procedures, enhancing grid infrastructure, and bolstering domestic manufacturing capabilities.

By drawing insights from established offshore wind energy markets, the thesis offers valuable recommendations for Türkiye to further enhance its regulatory framework and tender procedures. Adopting transparent and competitive auction mechanisms, implementing local content requirements, and providing clear regulatory guidelines will attract international investment and expertise, fostering the sector’s growth.

Looking ahead, Türkiye’s offshore wind energy sector holds immense promise, with the potential to significantly contribute to the country’s energy mix and decarbonization goals. By adopting best practices, fostering a supportive policy environment, and addressing remaining challenges, Türkiye can establish itself as a leading player in the global renewable energy market.

REFERENCES

[1] KÜTÜKCÜ, G., & YALILI, M. (2022). Investigation of country practices in offshore wind power plant projects and recommendations for Türkiye. Mühendislik Bilimleri ve Araştırmaları Dergisi, 4(1), 1–21. https://doi.org/10.46387/bjesr.1018423

[2] ESMAP. (2020). Offshore wind Technical Potential. https://esmap.org/node/197070 (Erişim tarihi: Eylül 21, 2021).

[3] Şentürk, A. E. (2020). Karasal ve Deniz Üstü Rüzgâr Çiftliklerinin Ekonomik ve Çevresel Etkilerinin İncelenmesi. Gemi ve Deniz Teknolojisi Dergisi, 217.

[4] Heronemus, W., & Joyce, D. (1972). Wind energy conversion systems. In Wind Energy Conversion (pp. 1-17). New York: Wiley.

[5] Global Wind Energy Council. (2023). Global Wind Energy Report 2023.

[6] Offshore Wind in Europe Key Ternds and Statistics. 2023.

[7] TÜREB & SHURA. (2023). Deniz Üstü Rüzgâr Enerjisi İhaleleri: Küresel Eğilimler ve Türkiye için Öneriler. Ankara: TÜREB.

[8] The Crown Estate. Offshore Wind Report 2022 https://www.thecrownestate.co.uk/media/4095/2021-offshore-wind-report.pdf

[9] Jansen, M., Beiter, P., Riepin, I., Müsgens, F., Guajardo-Fajardo, V., Staffell, I., Bulder,

B., Kitzing, L., (2022). Policy choices and outcomes for offshore wind auctions globally. https://www.sciencedirect.com/science/article/pii/S0301421522002257

We are here to guide you as the best lawyer in Izmir and to provide answers to your legal questions. Click the link to check out our other articles.

Follow us on social media:

https://www.facebook.com/kapitalhukuk